Both cards earn 5 points on travel through the Chase Ultimate Rewards® portal and 3 points on dining. Cardholders can earn 5 points per dollar on travel purchased through Chase Ultimate Rewards®, 3 points per dollar on dining, select streaming services, and online grocery purchases (excluding Walmart, Target and wholesale clubs), 2 points per dollar on all other travel purchases and 1 point per dollar on all other purchases.Īs you can see, there are some overlapping bonus categories with the Chase Freedom Flex. The Sapphire Preferred card charges a $95 annual fee. The Chase Sapphire Preferred® Card is the least-expensive personal credit card that unlocks the ability to transfer rewards to travel partners. Here are three cards to choose from if you decide to go this route: Pair with the Chase Sapphire Preferred® Card Alternatively, you can redeem points through the Chase Ultimate Rewards® travel portal at a bonus. That’s because you can combine the earnings from your Freedom Flex with earnings from one of these three cards to boost their value.Īfter combining these points, you’ll be able to transfer your Chase Ultimate Rewards® points to over a dozen airline and hotel partners-such as Southwest, United, Hyatt and JetBlue. The best way for travelers to boost their Freedom Flex stash is by pairing it with a Chase credit card that earns Chase Ultimate Rewards® points. Boost the Value of Your Freedom Flex Earnings These are provided as guidelines only and approval is not guaranteed. This is just one scoring method and a credit card issuer may use another method when considering your application.

#Chase freedom flex free

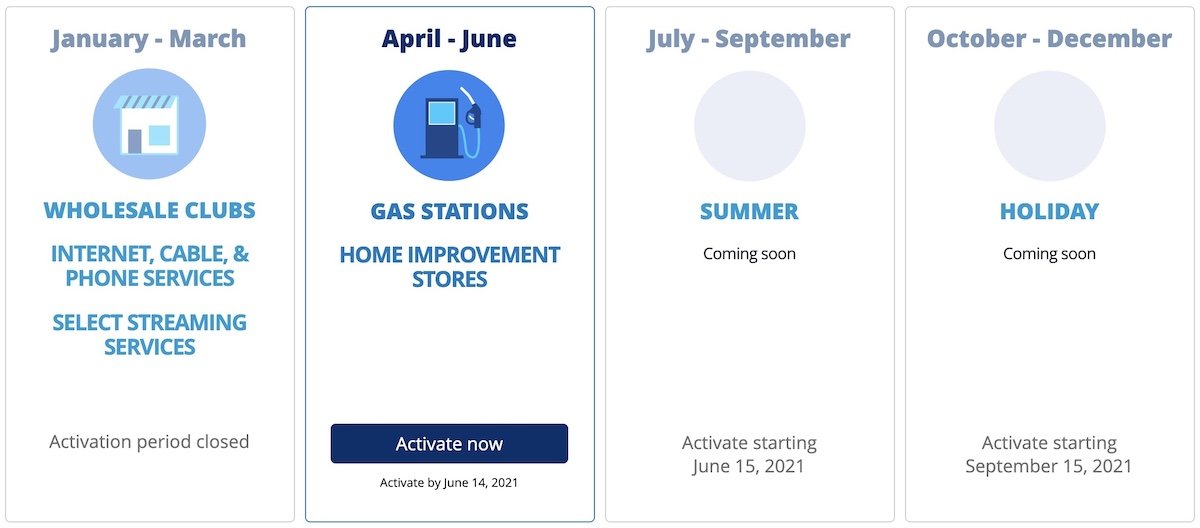

However, the Chase Freedom Flex℠ shines in four bonus categories: dining, drugstore purchases, quarterly rotating categories and travel purchased through the Chase portal.Īll of the bonus categories are uncapped, except for the rotating bonus category. There are plenty of great cash-back credit cards that offer a better return on everyday spending. Chase Freedom Flex Earning StructureĪt its root, the Chase Freedom Flex℠ earns 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstores and 1% on all other purchases. Let’s take a look at this credit card and which cards best complement it. There are three main ways that you can go: Boosting the value of your Freedom Flex earnings, boosting the return on everyday spending and/or boosting your cashback earnings in additional categories. While a solid card on its own, the true value of the Freedom Flex is unlocked when it’s paired with other credit cards. The Chase Freedom Flex℠ offers a lucrative earning structure and surprising benefits, especially considering it doesn’t charge an annual fee.

0 kommentar(er)

0 kommentar(er)